UltraTech Cement Ltd: Paving the Path to Market Leadership and Sustainability

Company Overview

UltraTech Cement Ltd., a flagship company of the Aditya Birla Group, is India’s largest manufacturer of grey cement, ready-mix concrete (RMC), and white cement. Established in 1983, the company has a strong presence across India, UAE, Bahrain, and Sri Lanka. UltraTech operates 23 integrated manufacturing units, 28 grinding units, and 7 bulk terminals, making it a leading player in the global cement industry. It has installed cement manufacturing capacity of approximately +140 million tonne per annum and has employee strength over 23000 in FY24. UltraTech is a pioneer in sustainability initiatives, with a focus on reducing carbon emissions, renewable energy adoption, and circular economy practices. It is committed to achieving carbon neutrality by 2050.

Return Summary

| YTD | 1 Month | 6 Month | 1 Year | 2 Year | 3 Year | 5 Year |

| 4.58% | -0.97% | 7.91% | 25.87% | 59.37% | 48.54% | 155.7% |

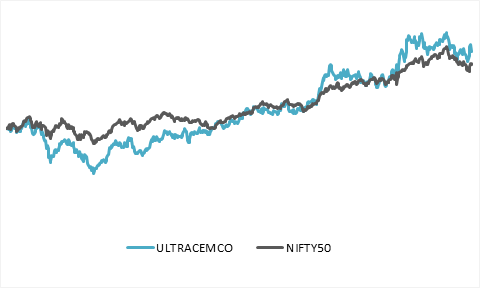

3 Year Return: UltraTech Cement v/s NIFTY

Result Highlights

- Revenue of ₹15,635 in Q2 and EBITDA of ₹2017, which is multi quarter low because of monsoon season, election pressure and high cost compared to revenue.

- UltraTech Cement’s capacity utilization at 68% with 3% growth in volume terms for Q2 FY25.

- The high-cost fuel contracts are at end and by Q3 the prices will further go down and costs dropping to ₹1.84 per Kcal, down 8% QoQ.

- Government focus on Metros, Roads, and Housing schemes will benefit cement companies.

- The company will be expanding its capacity by 8 million tons reaching 158 million tons capacity.

- The Kesoram Cement acquisition at ₹7500 crore, and it will strengthen and expand the south market footprint and will reach the target of total capacity of 200 million tons by 2028.

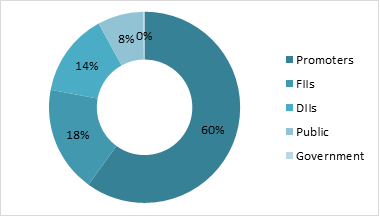

Shareholding Pattern

Return Comparison with Peers

| COMPANY | 1 Year | 2 year | 3 Year | 5 Year |

| UltraTech Cement | 26.03% | 59.57% | 48.72% | 156.08% |

| Ambuja Cement | 18.97% | (9.75%) | 37.77% | 150.30% |

| Shree Cement | (2.00%) | 9.05% | (1.54%) | 20.58% |

| JK Cements | 16.05% | 37.46% | 27.79% | 258.90% |

| JK Lakshmi Cements | (1.39%) | 15.34% | 23.17% | 173.19% |

Contribution to Industry Size

Being the largest cement company in Cement industry, UltraTech Cement with ₹318,000 crore market capitalizations having 24% market share of the industry. Expanding its footprint and having highest market share in North, South, West and East of India. Promoting the use of renewable energy resources for its production process and reducing the use of coal and pet coke. The company extensive operations include 23 integrated plants, 28 grinding units and 7 bulk terminals, enabling to serve the market efficiently.

Balance Sheet Analysis

- Reserves, fixed assets and capex is increasing every year, showing a great sign of growth.

- Company has debt on its balance sheet but has enough cash to pay it, hence it is net debt free.

- The excess cash is used to acquire new business to have more growth through inorganic way as business is at mature stage to grow fast.

Cash Flow Analysis

- Cash flow from Operations is ₹10,898 crore in FY24 and is positive for more than 10 years.

- Purchase of fixed assets is in increasing trajectory every year on year, showing a great sign of expansion and growth of company.

- The borrowing has been stable and is very low maintaining its debt to equity ratio.